In late 2023, Boston Real Estate Investors witnessed a significant advancement in housing development, notably in multifamily housing. This development was spurred by the compliance of 12 rapid transit communities with the state’s ambitious housing law.

These communities, Braintree, Brookline, Cambridge, Chelsea, Everett, Malden, Medford, Milton, Newton, Quincy, Revere, and Somerville, are strategically located with access to MBTA’s Red, Orange, Blue, and Green Lines. They successfully adopted new zoning plans ahead of the December 31, 2023 deadline.

The significance of this move lies not just in meeting a legislative requirement but in paving the way for the creation of over 83,000 new housing units.

The law in question is codified as Section 3A of Chapter 40A of the Massachusetts General Laws. It mandates each MBTA community to establish at least one zoning district of reasonable size where multifamily housing is permitted “as of right.” Additionally, to increase flexibility, revisions to the law last August allowed for mixed-use development districts.

The Massachusetts Government’s official page on the Multi-Family Zoning Requirement for MBTA Communities provides comprehensive information about the law, its requirements, and implications.

Boston Area Multi-Family Zoning Near Transit

Massachusetts is currently grappling with a severe housing crisis characterized by some of the nation’s highest and fastest-growing home prices and rents.

This soaring cost of living has placed an undue burden on low- and middle-income families, compelling them to prioritize housing expenses over other essential needs. Consequently, this escalates the risk of homelessness, but it also puts the state at a competitive disadvantage economically. With rising living costs, the threat of job growth migrating out of Massachusetts becomes more palpable.

In this context, creating zoning for multi-family housing emerges as a crucial solution. Historically, the absence of such zoning has been a significant obstacle to new housing development in the state. By facilitating the development of multifamily housing in proximity to transit hubs, Massachusetts can foster the emergence of walkable, transit-oriented neighborhoods. This approach transcends traditional housing policy; it’s an integral component of broader climate and transportation strategies.

Key Benefits for Boston Real Estate Investors

Enhanced Access to Daily Necessities: By situating more housing units near transit areas, residents gain more accessible access to essential amenities. These amenities include local shops, schools, jobs, restaurants, and parks. This proximity not only enriches daily life but also supports local economies.

Improved Mobility and Public Transit Utilization: Transit-oriented development inherently boosts access to work and other destinations. With more people living near transit stations, there’s an uptick in the use of public transportation. This, in turn, reduces the dependence on private vehicles and eases traffic congestion.

Contribution to Climate Goals: By encouraging public transit use, transit-oriented development plays a vital role in Massachusetts’ broader efforts to tackle the climate crisis. Additionally, it reduces reliance on single-occupancy vehicles, further contributing to these efforts. It aligns with the state’s environmental objectives by diminishing greenhouse gas emissions and promoting sustainable urban living.

Why is Boston Exempt?

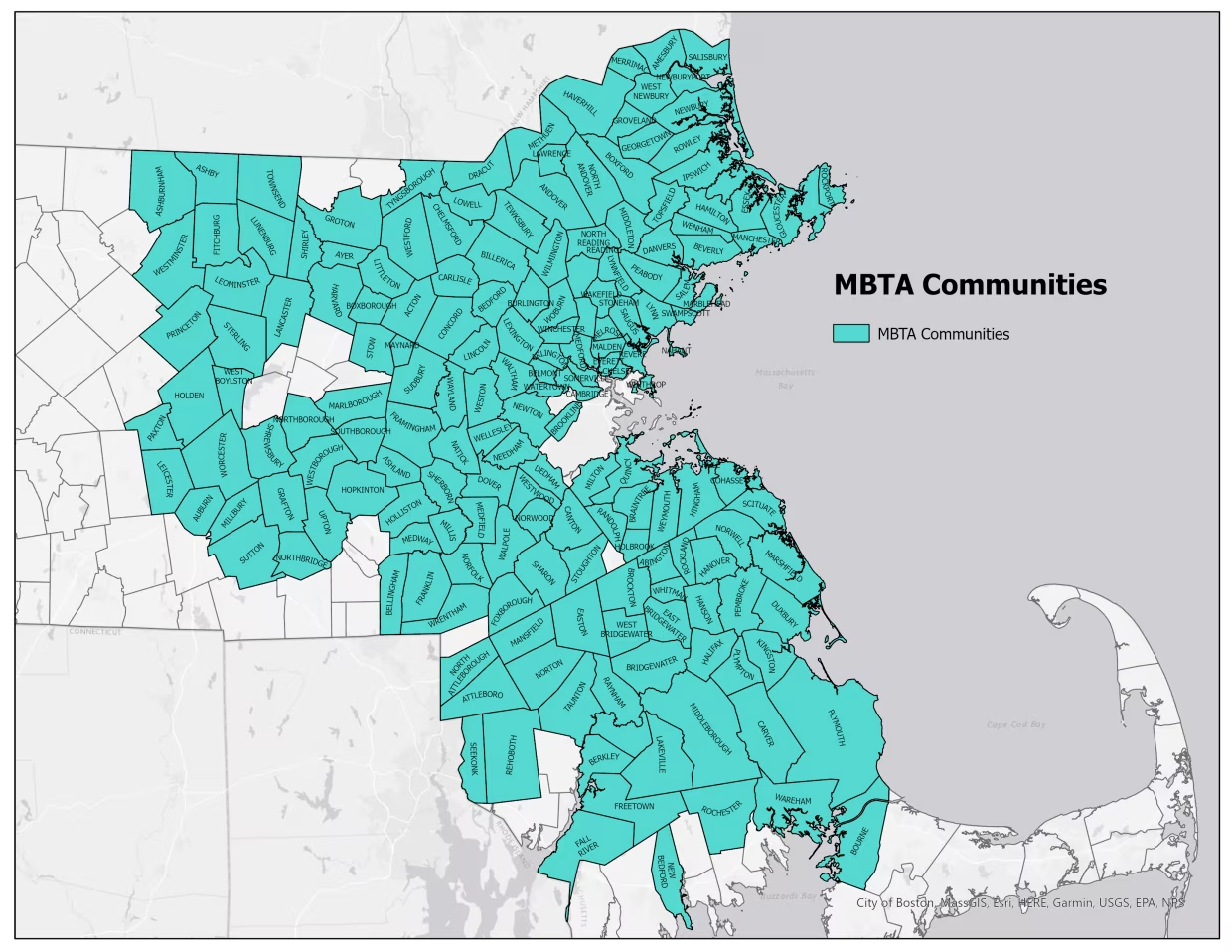

177 MBTA communities are subject to the new requirements of Section 3A of the Zoning Act. However, Boston is exempt from Section 3A of the Zoning Act since the MBTA serves it. Below is a map that illustrates this.

With all 12 communities meeting the deadline, compliance with these requirements was crucial. Not only was it essential for urban development, but they also were at risk of losing eligibility for various state funding programs. These programs include MassWorks and the Local Capital Projects Fund. The Everett Independent offers insights into how these communities have met the zoning requirements and the broader impact on housing development.

This zoning overhaul represents a landmark shift in urban planning and housing policy in the Boston area. It opens up many opportunities for real estate investors by allowing for greater density and housing types. This could increase property values and rental demand. The Massachusetts Municipal Association’s website, MMA, is a valuable resource for understanding the local government’s perspective on these zoning changes and their implementation.

Be A Prepared Boston Real Estate Investor

The amended laws in the Boston area are an evolving story with substantial implications for the real estate market. Real estate investors should be prepared to leverage this emerging opportunity.

Market Research and Analysis: Stay informed about the specific areas affected by the zoning changes. Understanding the demographics, current housing market trends, and future development plans is crucial. Utilize resources like local real estate reports, urban planning documents, and market analysis studies.

Network with Local Experts: Building relationships with local real estate agents, developers, city planners, and other investors can provide invaluable insights. These connections can offer early access to information about upcoming projects and potential investment opportunities.

Financial Planning and Funding

Another key point is that investors should assess their financial capacity and plan accordingly by securing financing, exploring partnerships, or considering various investment structures. Furthermore, It’s also important to know state or local incentives for developing near transit areas.

Exploring Diverse Investment Options: Consider the range of investment opportunities, from purchasing and renovating existing properties to participating in new development projects. Opportunities include traditional residential rentals, mixed-use developments, or affordable housing projects.

Understanding Regulatory Requirements: Familiarize yourself with the specific zoning regulations and any changes that might affect development plans. Understand the requirements for multifamily units, building heights, density, and other zoning specifications.

Massachusettes Urban Development

As Mass. embarks on this transformative journey in urban development and real estate, being well-prepared and informed is critical for investors looking to capitalize on these emerging opportunities.

Like any investment, real estate in transit-oriented areas carries certain risks. Investors should evaluate market volatility, potential changes in public policy, and economic trends.

Be prepared to adapt your strategies as new information and opportunities arise. Also, Reviewing and adjusting investment plans can help maximize returns while mitigating risks.

With Flipsquad.io, Boston Real estate investors can gain quick and efficient access to a wealth of hourly, up-to-date listings of investment properties. This ensures investors are always at the forefront of the latest opportunities, equipped with the knowledge and tools to make strategic decisions in this dynamic market.

Our database is continually updated to deliver the most up-to-date and pertinent information on the housing market and availability. With SARV scores calculated in real-time for each query, our estimates offer exceptional accuracy, enabling you to make informed decisions in your house-flipping ventures. It’s an essential partner for anyone serious about maximizing their real estate investment potential.